In 2015, VC market price remains low, but it is unlikely to rise. It’s estimated that VC price will maintain stable or edge down at the beginning of 2016, under the background of serious overcapacity, according to CCM.

In 2015, domestic VC market loses momentum.

Q1

According to CCM’s price monitoring, the market price of 99% feed grade VC (powder) was USD3,901/t in March, down by 1% from Jan. Since the market inventory of VC was large and some of distributors adopted price-cut strategies to lift sales, VC price was unlikely to rise.

Q2

The market price of 99% feed grade VC (powder) was USD4,085/t in June, up by 4% compared with April figure. It's known that the main VC manufacturers were willing to jointly raise prices to get rid of the adverse circumstances during the business operation.

Q3

The average market price of 99% feed grade VC (powder) was USD4,250/t in Q3.

Manufacturers averagely quoted USD3,998/t (RMB26/kg) for 99% food grade VC (powder) and USD3,767/t (RMB24.5/kg) for 99% feed grade VC (powder).

VC price maintained high level, mainly due to production reduction.

-

For one thing, main manufacturers suspended production for plant maintenance during summer. Only CSPC Pharmaceutical Group Limited (CSPC) and Shandong Tianli Pharmaceutical Co., Ltd. (Tianli Pharmaceutical) shut down part of production lines for overhaul in rotation.

-

For another, Luwei Pharmaceutical Co., Ltd. (Luwei Pharmaceutical) has suspended VC production and followed the environmental protection requirements to make rectification.

Q4

The market price of 99% feed grade VC (powder) averaged at USD4,100/t in Q4, down by 4% from Q3.

Manufacturers generally quoted USD3,690/t (RMB24/kg) for 99% food grade VC (powder) and USD3,537/t (RMB23/kg) for 99% feed grade VC (powder).

As domestic main VC manufacturers resumed production, the supply of VC subsequently increased. Meanwhile, downstream farming industry entered slack season, the demand for feed grade VC decreased.

Generally speaking, 2015 witnesses a disappointing VC market. Serious overcapacity is the main reason. At present, the global demand for VC is approximately 120,000 tonnes. VC supply is dominated by 5 Chinese manufacturers, CSPC, Northeast Pharmaceutical Group Co., Ltd., Tianli Pharmaceutical, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd., Luwei Pharmaceutical, and replenished by DSM.

In 2015, the mentioned five Chinese manufacturers are capable of 150,000 t/a VC, whose output is estimated to reach 125,000 tonnes, essentially the same as global demand.

In Jan. 2016, it’s forecasted that the demand for VC will on the rise from downstream farming industry. Under the impact of severe overcapacity, VC price is unlikely to grow and maintains stable. For Q1 2016, it's predicted that VC price will decline. If price continues to fall, small manufacturers would withdraw from the market.

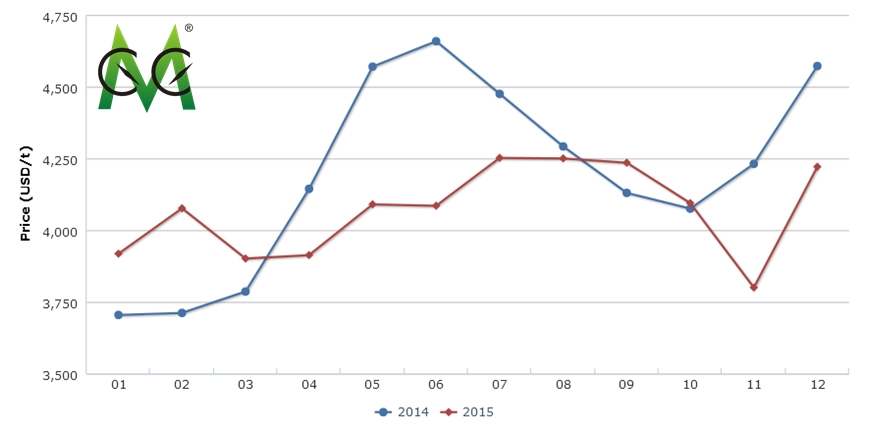

Monthly market price of 99% feed grade VC (powder) in China, Jan. 2014-Dec. 2015

Source: CCM

If you need more information about VC in China, why not get a free-trial of CCM’s Online Platform? You can get much more information about VC or even the whole vitamin market for free!

GET FREE TRIAL NOW!

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: VC